Economic Analysis of Operating a Thermal Desorption Unit in 2025

- lee784287

- 2025年6月4日

- 讀畢需時 3 分鐘

The thermal desorption unit (TDU) has become a cornerstone in the remediation of hydrocarbon-contaminated soils, drill cuttings, and refinery sludge. In 2025, the economics of operating such a system are shaped by a confluence of regulatory tightening, advances in thermal efficiency, and rising demand for environmentally sound waste management. Investors and operators are increasingly focused on capital expenditure recovery, throughput optimization, and the monetization of byproducts.

Capital and Operational Expenditures

Initial capital expenditure (CAPEX) for a thermal desorption unit can range from $1.5 million to $5 million, depending on processing capacity, level of automation, and design customization. Modular skid-mounted systems reduce civil infrastructure costs and improve deployment flexibility. However, the upfront investment must be weighed against expected lifecycle performance and throughput scalability.

Operational expenditure (OPEX) is highly dependent on feedstock characteristics. Moisture content, hydrocarbon saturation, and particle size influence fuel consumption, which is typically the most significant variable cost. Units operating with natural gas or diesel experience fluctuating fuel costs, although waste-heat recovery systems and advanced insulation materials have reduced thermal losses by up to 20% in the latest designs. Labor and maintenance are additional OPEX drivers, with automated controls reducing staffing requirements in high-throughput configurations.

Processing Economics and Throughput

Pyrolysis plant profitability is largely tied to processing volumes and tipping fees. In 2025, average tipping fees for oily sludge treatment range between $80 and $150 per metric ton, varying by region and contaminant class. A mid-sized unit processing 10 tons per hour, operating 300 days annually, could generate over $25 million in gross revenue from treatment services alone.

Throughput consistency is critical. Feedstock homogenization and pre-screening enhance thermal contact and vaporization uniformity, ensuring compliance with local emission standards while maximizing hydrocarbon recovery rates. When co-located with oilfields or tank farms, TDUs benefit from stable waste streams and reduced logistics costs.

Byproduct Recovery and Market Integration

Volatile hydrocarbons vaporized during desorption can be condensed and recovered as usable oil. Depending on feedstock composition, recovery rates range from 5% to 15% by weight. In regions where bunker fuel and pyrolysis oil markets exist, this recovered oil becomes an additional revenue stream. Furthermore, the cleaned solid residue, often meeting regulatory standards for reuse, can be repurposed as aggregate in construction or road base materials.

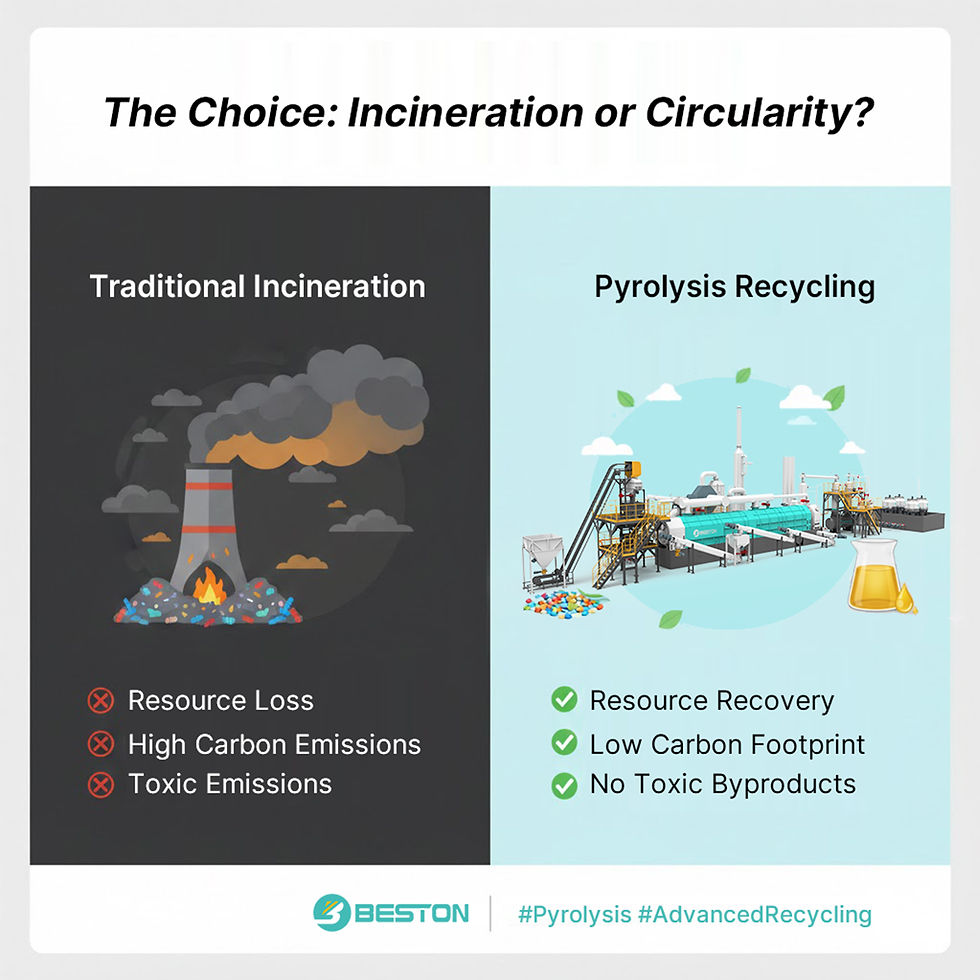

Integration with waste-to-energy facilities or downstream fuel refining units enhances overall project economics. In many jurisdictions, such integration can also secure carbon credit eligibility, especially when offsetting emissions from incineration or landfill disposal.

Regulatory and Carbon Cost Considerations

Stringent environmental regulations continue to shape the economic calculus. In 2025, the cost of non-compliance—ranging from fines to operational shutdowns—has made continuous emission monitoring systems (CEMS) and real-time data logging standard features. Additionally, jurisdictions with carbon taxation or cap-and-trade frameworks increasingly recognize TDUs as low-emission alternatives, providing operators with opportunities for offset generation.

Tax incentives for pollution control equipment, green finance instruments, and public-private partnerships also contribute to reducing financial risks. As more governments push for circular economy models, thermal desorption units stand as viable infrastructure for sustainable waste valorization.

Conclusion

Operating a thermal desorption unit in 2025 offers a blend of environmental compliance and commercial viability. With proper feedstock sourcing, optimized system design, and strategic integration, the economic return can be both measurable and resilient. The technology not only remediates complex waste streams but also aligns with global trends in energy recovery and carbon-conscious industrial practices.

留言